Seeking Alpha

Three weeks ago Google (GOOG) launched a new social networking product, Google+, on a limited invitation only basis. In this article I am going to discuss the implications Google+ will have for Google’s future business and provide some key insights into why it is important.

During Google’s earnings call last Thursday 14 July, Larry Page announced that in its first two weeks of limited release 10 million people have joined Google+ and have been sharing over 1 billion items per day. Incidentally Larry Page, who is enjoying a stupendous first quarter as the company’s new CEO, also posted a transcript of his announcement on Google+ which has subsequently been shared by Google+ users 1,000 times and +1’ed nearly 10,000 times (more on that in a minute). For the quarter Google’s revenue is up 32% year over year and has set a new record for quarterly revenue at over $9 billion. On the news Google shares shot up nearly 13%.

According to Page, “[Google’s] goal with Google+ is to make sharing on the web like sharing in real life, as well as to improve the overall Google experience.” While a lot of press has been devoted to Google+ as a challenger to Facebook and Twitter, Page had additional words that may indicate that the company hasn’t lost any competitive focus on Apple either. “Google+ is also a great example of another focus of mine--beautiful products that are simple and intuitive to use and was actually was one of the first products to contain our new visual redesign,” he said.

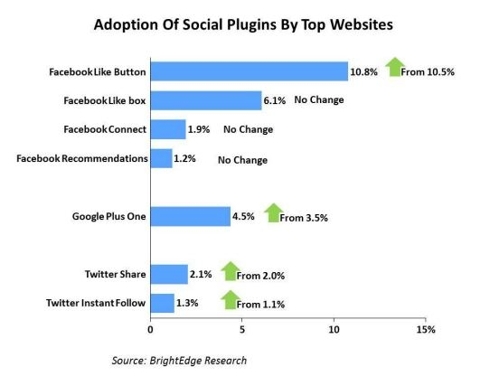

Preceding the launch of Google+, last quarter the company also launched the +1 button in search results and ads -- enabling users to recommend stuff they liked, and have those recommendations show up in the search results of people they know. The +1 button is often compared to the Facebook “Like” button however the message is intended to be slightly different. This quarter, the +1 button was launched to the entire web, and many sites like Huffington Post, the Washington Post (WPO), and Best Buy (BBY) have added +1 buttons. Today the +1 button is all over the web and is being served 2.3 billion times per day.

Soon enough I imagine the SeekingAlpha webmasters will add the +1 button right alongside the LinkedIn Share button at the top of each article. You can also follow me on Google+ to stay up-to-date on the latest market news and innovations.

Beyond the extension of Google’s service offering, Page also announced that the company has 550,000 Android Devices activated each day. The Android platform has quickly caught pace with the Apple (AAPL) iOS platform on smartphones, although it still holds less than half the market share of iOS when you include tablet and iPod sales. These growth numbers are nothing to be scoffed at however, especially when you consider that Android’s market share has risen from around 5% in January 2009 to 20% in May 2010 while iOS has drop from 75% to 59% in the same time period. Additionally, Google’s Chrome browser is also the fastest growing browser on the market now with over 160 million users.

Source: BrightEdge Research, "Social Share Report," July 2011.

What this means for Google and Google users is:

- Growth – Google’s reach of influence is rapidly expanding and becoming increasingly integral to a greater scope of even more people’s lives. Their user base is increasing and Google has a proven track record of monetizing their users.

- Personalization – as users and those in their network use Google+ and the +1 button search will become increasingly personalized. This means that my search results will not always match your search results eventually creating a significant product advantage that is not easily replicated by competitors. This is already happening.

- Integration – the ties that connect the user experience between Google search, Gmail, Google+, and Android as well as Google’s other products will become more seamlessly bound. This is already apparent for users of the Android OS. Integration creates brand loyalty and stickiness which drastically increases switching costs.

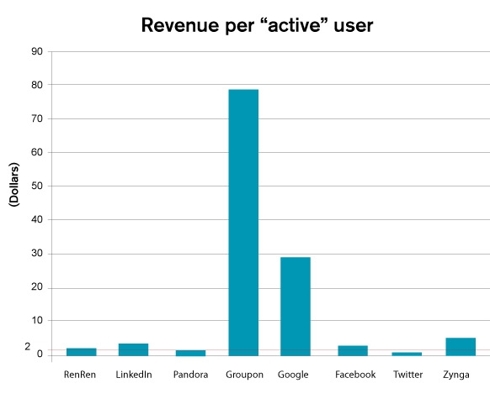

Footnotes: 1.) The figure for Google users refers to the number of unique monthly search users, which doesn't reflect all the people that see its ads and use its services. 2.) The figure for Groupon users refers to reported "cumulative customers" in 2010. 3.) The figure for active Zynga users refers to "monthly unique users" from October through December 2010. 4.) The figure for active Twitter users refers to a recent report from Business Insider that found that only 21 million Twitter users follow 32 or more accounts. Twitter considers an "active" user to be someone who is following 30 accounts, with a third of those accounts following back. 5.) Revenue figures for Facebook and Twitter are based on estimates from eMarketer, a research firm. 6.) Revenue figures for Zynga and Groupon come from their IPO filings with the Securities and Exchange Commission.

Source: “How much is a user worth?” Technology Review India, MIT, 12 July 2011.

Furthermore, as Google stampedes down the road of expansion their M&A activity is going to increase. Earlier this month at the Sun Valley conference in Idaho, Google Executive Chairman Eric Schmidt explainedhis expectation for an explosion of startups built around the Google+ platform:

“You could image the scenario where the social platform is so successful that you’ve got startups that are building on top of Google + that are so incredibly sexy and exciting that we would pay top dollar very fast … That’s a great scenario because then you know you’re winning.”

According to Schmidt, Google M&A made the decision last year to accelerate the acquisitions of companies below the Hart-Scott-Rodino Act threshold, or the amount that is subject to FTC notification requirements and a waiting period (currently $66 million and 30 days). Google is targeting companies such as Punchd that they are acquiring for around $10 million, versus AdMeld for $400 million, in order to fill gaps in their broader development strategy. Schmidt emphasized that M&A at Google is driven from the bottom up, “A product manager that has a problem and [needs to] solve that problem” is the impetus for many potential acquisitions.

All signs point to an increased rate of growth. As Google continues to propagate a progressively more dedicated, integrated, and subsequently monetized customer base, Google+ is going to provide the fuel for rapid acceleration. To anyone standing in their way: look out.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.